Corporate Restructuring Includes Capital and Asset Restructuring as Well as

Financial restructuring may occur to changes in the market or legal environment and are needed in order for the business to survive. Before capital restructuring is implemented the company must carefully analyze its liquidity and capital.

Methods Of Restructuring Ceopedia Management Online

Principle 16-Special Incentives and Powers 6.

. Today restructuring is not an option but a conscious choice made by companies. Corporate restructuring may take place as a result of the acquisition of the company by new owners. Capital restructuring asset restructuring and management restructuring.

Asset restructuring is a cost that may occur during the entire process of strategically writing off. CSC Capital Corporate Restructuring is a process to revitalize and to increase the value of a business by redesigning the organization and the relationships between all business functions. Increased productivity due to technology has A.

The process begins with a comprehensive analysis that measures the performance of a business. Thus the rationale of corporate restructuring is-. Corporate restructuring includes capital and asset restructuring as well as Multiple Choice technology restructuring procurement restructuring global diversification.

What Is Corporate Restructuring Explain With Example. Financial restructuring may occur to changes in the market or legal environment and are needed in order for the business to survive. In todays market proper restructuring of stressed assets and liabilities may allow good companies to survive.

As to enhance the value of the firm. Principle 15-Corporate Restructuring 5. Definition of corporate restructuring.

Capital restructuring is a corporate operation aimed at changing the ratio of equity and debt in a firms capital structure. Its usually a one-time expense that needs to be funded by any company when the restructuring takes place. This initial audit very quickly evaluates the levels of effectiveness within an organization and.

Increased corporations reliance on debt for capital expansion needs. Reasons for Capital Restructuring. Made it cheaper in terms of interest costs for firms to borrow money.

Capital restructuring involves improving the debt equity ratio adding different classes of dubt and equity. Corporate financial restructuring involves any substantial change in a companys financial structure or ownership or control or business portfolio designed to increase the value of the firm. This usually happens when a company is facing significant problems and is in financial danger.

However financial restructuring may take place in response to a drop in sales due to a sluggish economy or temporary concerns about the economy in general. When this happens the corporation may need to reorder finances as a means of keeping the company. Created larger asset values on the firms historical balance sheet.

Getting rid of underutilised assets like brands and intellectual rights. Corporate Restructuring means rearranging the business of a company for increasing its efficiency and profitability. According to the text corporate restructuring includes D.

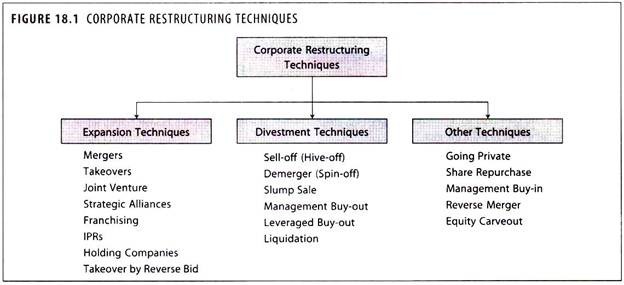

Restructuring can involve changes in assets capital structure or management. Types Of Corporate Restructuring. Oftentimes restructuring refers to a way of reducing the size of a business and making it small.

The changes may include entering into an agreement with creditors on debt repayments and restructuring the companys capital structure Capital Structure Capital structure refers to the amount of debt andor equity employed by a firm to fund its operations and finance its assets. Asset restructuring involves selling off unproductive assets and product lines and acquiring complementary assets needed to improve the business. The objective of corporate restructuring is to greatly modify or change the capital structure of a corporation or its business operations.

Principle 14-Asset Sales 4. Corporate Restructuring focuses on cost reduction and improving efficiency and profitability. There are generally two different forms of corporate restructuring.

The reason for restructuring will determine both the type of restructuring and the corporate restructuring strategy. The measures are part of the companys. Like death and taxes bank failures and systemic financial sector distress appear to be facts of life in the industrial world as well as developing and.

According to the text corporate restructuring includes management restructuring _____ restructuring and _____ restructuring. The reason for restructuring will determine both the type of restructuring and the corporate restructuring strategy. It is usually done in response to a crisis such as.

Corporate Restructuring Characteristics. Corporate restructuring includes capital and asset restructuring as well as Multiple Choice technology restructuring. Helped to keep corporate costs in check.

Capital and asset TF. Corporate restructure happens when an entity goes through great financial distress and could very well go out of business. There are generally two different forms of corporate restructuring.

Corporate restructuring includes capital and asset restructuring as well as Multiple Choice technology restructuring procurement restructuring global diversification. Divesting of businesses can accomplish many different objectives including enabling managers to focus their efforts more directly on the core business of the firm. Business restructuring is a corporate action take to significantly change the structure or operations of the company.

A firms capital structure or its assets and liabilities. 3 types of restructuring are asset restructuring capital restructuring and management restructuring. To enhance the companys balance sheet by disposing of the unprofitable division from its core business Reduction in personnel by closing down or selling off the unprofitable portion Corporate management changes.

Firm and its owners by altering the firms capital structure asset mix and the organization so. For example a corporate entity may choose to restructure their. Asset Restructuring is the process of buying or selling of a companys assets that comprise of far more significant than half of the target companys consolidated assets.

Purchasing or selling distressed businesses divisions or assets Capital reorganizations including reverse stock splits and exchange offers Restructuring debt whether public private or commercial Restructuring commercial obligations with counterparties to enhance asset marketability Representing distressed businesses in Chapter 11.

Corporate Restructuring As A Solution For Business Failures Ipleaders

Corporate Restructuring Ivan Cavric Corporate Portfolio Management

0 Response to "Corporate Restructuring Includes Capital and Asset Restructuring as Well as"

Post a Comment